When you file a personal injury claim against a defendant after an accident, at some point, you will eventually have to negotiate with their insurance company. Even if you file a personal injury case against the defendant, settlement negotiations may take a while, and your case could be resolved out of court at any moment. You need to be ready for whatever happens throughout the legal process.

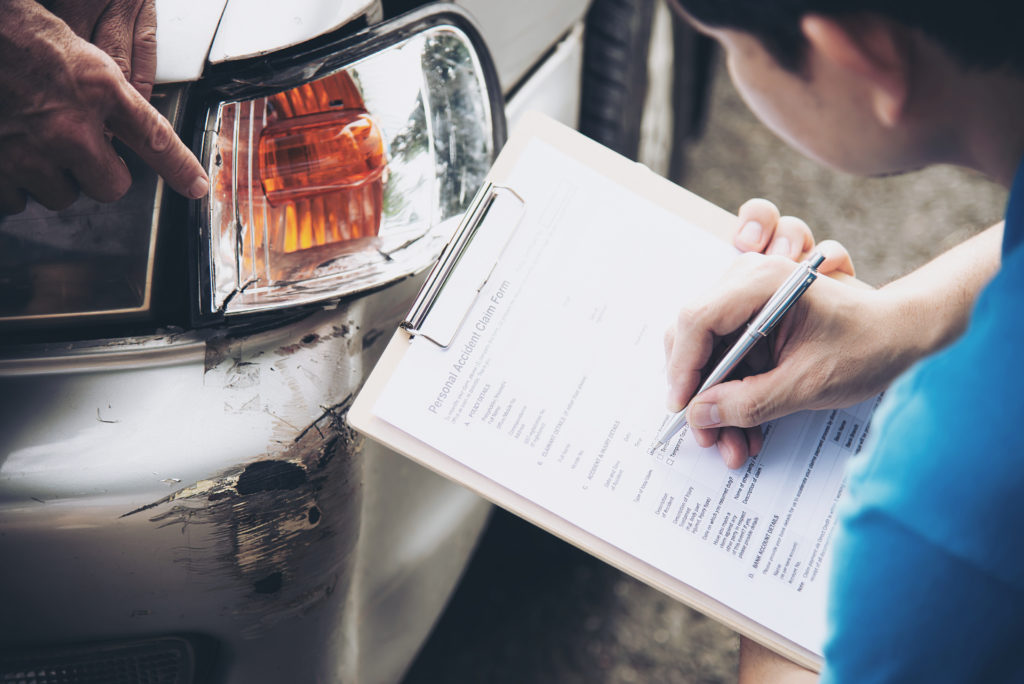

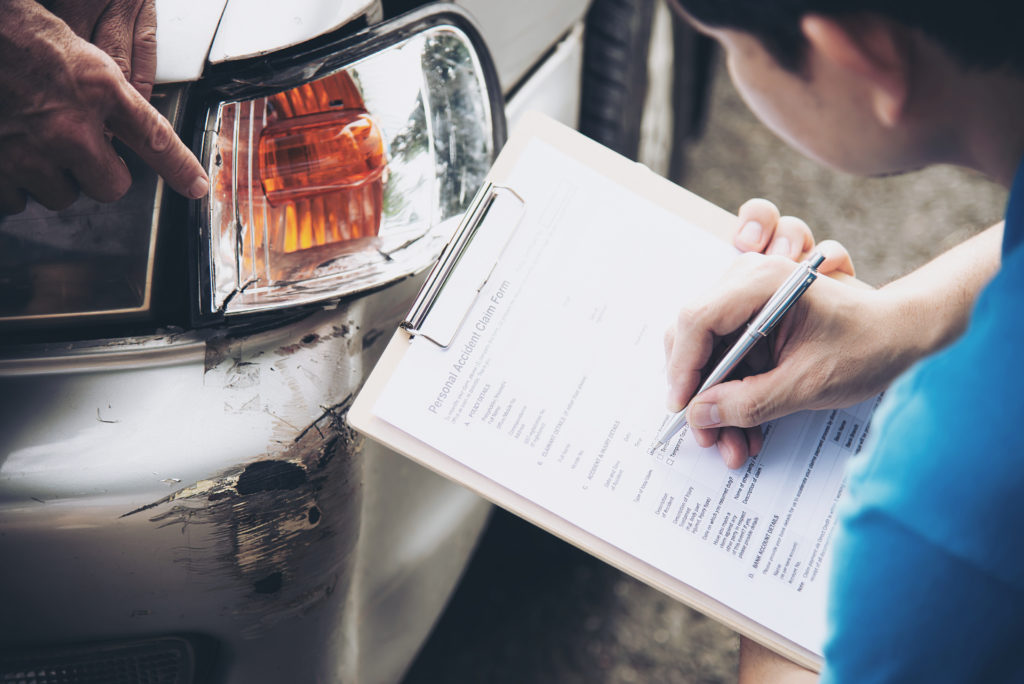

The negotiation phase can be simplified if your personal injury attorney presents the defendant’s insurance company with a well-organized demand letter and supporting documentation. They may be able to settle your claim with an insurance claims adjuster by making a few phone calls. However, the biggest picture is this: the insurance adjuster, along with you or your attorney, will point out your claim’s strengths and weaknesses through informal conversation or written correspondence. The adjuster will then attempt to settle your claim for a lower amount than what your demand letter requested. Eventually, an agreed-upon settlement will be issued for an amount that is in-between what you initially demanded.

For your claim to be successful, the following article will discuss how it should be best positioned.

Determine the Worth of Your Claim

As you are putting your demand letter together, you need to determine the worth of your claim. Before speaking with an adjuster, decide on a minimum settlement amount that you would be willing to accept. This figure should be kept to yourself during the negotiation, but you want to ensure that you’re always keeping your bottom line in mind, even though you won’t be revealing this amount to the insurance adjuster. You should also understand the types of compensation available in a personal injury lawsuit.

This figure doesn’t have to be set in stone. It may need to be lowered if the adjuster points out some facts you might not have considered that weaken your claim. If the adjuster offers an amount near the minimum amount you are willing to accept, you may want to increase your figure.

Reservation of Rights Letter

If the insurance company sends you a “reservation of rights” notice in the mail, don’t be intimidated or alarmed. The letter merely informs you that they are investigating your claim but are reserving the right not to issue you a settlement if they determine that the accident isn’t covered under one of their policies. The letter prevents you from claiming that the company’s insurance policy covers your accident because they initiated settlement negotiations with you.

Do Not Accept the First Offer

The insurance adjuster may try to see if you understand what you are doing by attempting to issue you a lowball settlement. The offer could also be a reasonable lowball settlement. You should only accept a fair offer, and even then, you should make a slightly higher counteroffer. This will show the adjuster that you are willing to be reasonable and compromise with them. With a little more bargaining, you should be able to reach a final settlement that both of you will agree to.

Ask the Adjuster to Justify Their Lowball Offer

If the adjuster gives you a lowball settlement offer as a negotiating tactic to see if you know how much your claim is worth, do not lower the amount you requested in your demand letter. Ask them to specify why they are offering you a low amount and make some notes of what they told you. You should then write a short letter responding to each of the reasons the adjuster discussed with you.

You can lower your settlement offer slightly, depending on the validity of the reasons given by the adjuster. However, you should wait and see if the adjuster will modify their offer after receiving your reply before you lower the amount very much.

You should ask the adjuster to respond to your reply letter the next time you speak with them. The adjuster should make a more reasonable offer, at which point you will be able to negotiate a fair settlement amount. Most personal injury lawsuits are eventually settled. It’s just a matter of when.

Underscore Emotional Reasons

During the negotiating phase, you shouldn’t rehash the facts again. Instead, you need to underscore the most vital points of your argument:

- That the accident was entirely the insured defendant’s fault, you sustained painful injuries.

- Your medical expenses were reasonable.

- The injury left you with permanent or long-term physical impairments.

It may help your cause to discuss any emotional aspects that support your claim. For instance, if you sent a photo of a smashed car or a severe injury to the adjuster, you should refer to it. If your injury impacted your ability to take care of your child, you should mention that your child has also suffered from the accident. There may not be a way to put an exact dollar value on pain and suffering or emotional distress, but the components of your losses, or damages, could go a long way toward convincing the insurance company to offer you a fair settlement.

Put the Terms of the Settlement in Writing

Once you and the defendant’s insurance adjuster have finally reached an agreement, the terms should be confirmed in writing to the adjuster immediately. The letter should be brief, indicating the amount agreed upon, what damages or injuries the settlement covers, and the date you expect the insurance company to send you the settlement documents.

Get Professional Legal Assistance

It is generally beneficial to hire an attorney early in the process to help you deal with the insurance company. The company will typically have a team of attorneys on their side who do nothing but insurance defense cases. This means they know their jobs well, and you will be at a disadvantage to them unless you have legal counsel of your own. Insurance companies tend to treat claimants differently when they know a lawyer is involved because they are aware that the attorney will be looking at claims closely.

At the same time, having an attorney handle dealing with the insurance company will alleviate some of the stress involved. This is particularly helpful when dealing with the aftermath of an accident where there may be physical injury and emotional trauma. While there may be a temptation to handle the process on your own, an attorney can help ease the burden and get you a better settlement than you could have gotten on your own. At the very minimum, they will assess whether the settlement offer made by the insurance company is fair and reasonable.

Settlement Negotiations and Lawsuits Will Take Time

Individuals involved in personal injury lawsuits may find themselves asking why their case is taking so long. The answer to that question is multi-faceted, and many factors come into play regarding the length of such a case, such as the settlement negotiation process. Many personal injury plaintiffs find themselves in difficult financial situations as they either wait for a settlement to be offered or processed. During this time, medical bills, legal fees, and other expenses will begin to rise.

The Legal Funding Group offers lawsuit funding for plaintiffs looking for financial help during the litigation process. Call (912)-777-3997 for more information or fill out a quick online application to get approved.